10 Ways You Waste Money Without Meaning To

Sometimes I leave food in the fridge until it turns into a science experiment just so I don’t have to feel guilty throwing it away. It doesn’t make me feel as guilty if I wait to throw it away until after it would actually make someone sick if they ate it.

Sometimes I leave food in the fridge until it turns into a science experiment just so I don’t have to feel guilty throwing it away. It doesn’t make me feel as guilty if I wait to throw it away until after it would actually make someone sick if they ate it.

Frugal living has become a way of life for so many of us since the economy turned south but many of the things we do every day have us unintentionally wasting money and take a chunk out of the family budget.

1. Letting Food Go Bad

For many families, groceries are the highest non-fixed expense in the family budget. While shopping the sales, using coupons, and sticking to a menu plan can save hundreds of dollars a month, you are still spending too much money if the food you buy is going bad before it is eaten. Having a well stocked pantry is wonderful for menu planning and helps families be prepared in case of an emergency, but it is essential that the foods in the pantry be rotated on a regular basis.

Place foods at the back of your pantry when coming home from the grocery store and check your pantry for items that are nearing their expiration date once a week. Produce, meat, and dairy products can go bad quickly if you don’t plan ahead. Freeze meat that is not going to be used within a day or so to keep it fresh. Keep fruit in bowl on your counter or somewhere visible so that your family can grab it quickly for a snack. Plan a weekly stir fry or soup night to use up leftover veggies before they go bad. Always check your pantry before planning meals for the week so you can take advantage of food you already have and avoid buying more than your family can eat.

2. Not Having a Menu Plan

Laura, who blogs at I’m an Organizing Junkie, home of Menu Plan Monday is a firm believer in menu planning. She says:

Menu planning has been such a lifesaver for me for many reasons but one of the biggest is definitely the amount of money I’m able to save at the grocery store. Knowing what I’m going to prepare for dinner each day, a week in advance, allows me to create a specific grocery list for just the items needed. I’m not purchasing food that will go to waste in my fridge or collect dust in my pantry. Additionally, I’m able to plan meals around what is on sale that week and use corresponding coupons to further enhance the savings. I also find it helpful to schedule in a leftover day sometime during the week to ensure any leftovers aren’t going to waste. If you haven’t given menu planning a try, I highly recommend it!

3. Not Using Coupons

Coupons used to terrify me. I mean come on, I’m a work at home mom with 3 kids at home – how in the world could I afford to take the time to cut coupons and match up deals every week? After seeing the savings that were possible from combing sale items with coupons, I now think of my time cutting coupons as time that I’m being paid for. My hourly rate for cutting coupons averages about $20 an hour which makes a big difference in my grocery budget.

Coupons used to terrify me. I mean come on, I’m a work at home mom with 3 kids at home – how in the world could I afford to take the time to cut coupons and match up deals every week? After seeing the savings that were possible from combing sale items with coupons, I now think of my time cutting coupons as time that I’m being paid for. My hourly rate for cutting coupons averages about $20 an hour which makes a big difference in my grocery budget.

Shelly, a full-time fourth grade teacher who blogs at the Coupon Teacher says:

I shop at a grocery store chain named Harris Teeter. It is a high end chain, so I never know what I am going to run into there. I consider myself to be an extreme couponer, and I don’t expect everyone to be the same. I am however, I little tired of seeing women throwing their money away by not using any coupons. The other day I was behind such a woman in line. I checked out her full cart, and I hoped she had at least a few coupons. The checker was scanning her items, and I was amazed. I knew I had coupons at home for over a third of the items she purchased. The cashier said, “Two hundred seven dollars and ninety-one cents.” My jaw just about fell to the floor! I could have saved that woman at least $50, just on the cart of groceries she had with coupons from the recent Sunday paper. She could have done it herself with very minimal effort. Is 30 minutes a week worth $50 to you?

4. Not Caring for Clothing

Clothing can last for years for adults and can be passed on to younger children if it is well cared for, but it can easily be ruined in the laundry or during every day use if you are not careful. Replacing clothing before you have gotten full use out of it can really eat into your family budget. How many times have you pulled a load of laundry out and found that you shrunk your children’s clothing or turned your son’s white shirt pink? Follow instructions on clothing tags carefully to avoid wearing them out at a faster rate. Line drying helps clothes last longer and will save you money on your utilities. Treat stains right away to keep clothes looking nice and always protect children’s clothing while they are eating something that could stain or working on an art project.

Clothing can last for years for adults and can be passed on to younger children if it is well cared for, but it can easily be ruined in the laundry or during every day use if you are not careful. Replacing clothing before you have gotten full use out of it can really eat into your family budget. How many times have you pulled a load of laundry out and found that you shrunk your children’s clothing or turned your son’s white shirt pink? Follow instructions on clothing tags carefully to avoid wearing them out at a faster rate. Line drying helps clothes last longer and will save you money on your utilities. Treat stains right away to keep clothes looking nice and always protect children’s clothing while they are eating something that could stain or working on an art project.

5. Not Maintaining Your Car

Car maintenance is one of those things that is easy to forget. Yea, so you notice the car is making a horrible screeching noise when you drop the kids off at school that makes everyone else in the drop off lane stare at you. It went away afterwards, why worry about it? Car repairs can add up quickly and can create unexpected expenses that many of us are not prepared to handle. Not properly maintaining your car can shorten the overall life of your car and create far more expensive repairs down the road.

Have regularly scheduled oil changes, rotate your tires every 5000 miles or so, and have strange noises or check engine lights checked out right away. Many auto stores will plug your car into their computer for free if your check engine light comes on and let you know what the problem is. A little maintenance on your car now, could prevent a huge expense later on.

6. Not Planning Ahead

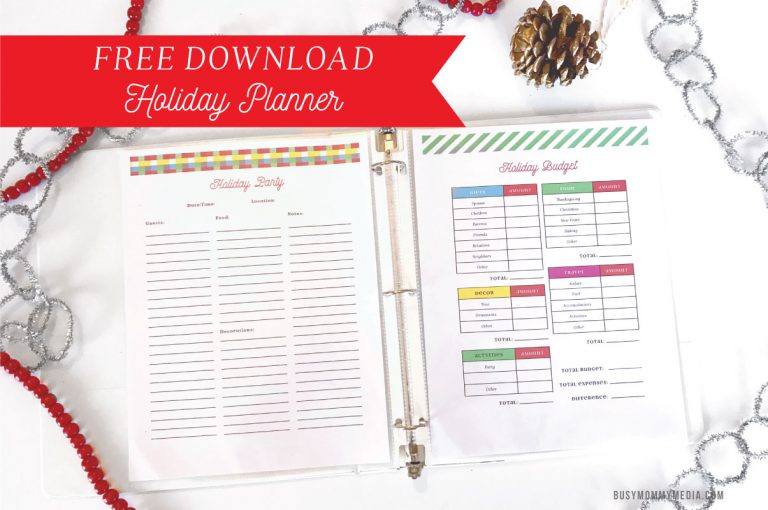

Whether it is not leaving enough time to pack a lunch so you or your kids have to buy a lunch or not packing the things you need for a vacation so you have to buy essentials while you are gone, not planning ahead can cost you money. Shopping for birthday and holiday gifts before-hand allows you to buy items while they are on sale instead of paying high prices at the last minute.

Whether it is not leaving enough time to pack a lunch so you or your kids have to buy a lunch or not packing the things you need for a vacation so you have to buy essentials while you are gone, not planning ahead can cost you money. Shopping for birthday and holiday gifts before-hand allows you to buy items while they are on sale instead of paying high prices at the last minute.

7. Not Having Insurance

I’ve heard many people say that they just can’t afford insurance, but if you are living on a budget, you can’t afford not to have insurance. Unexpected medical expenses, from either illness or injury, can very quickly create insurmountable debt. No parent wants to feel like they can’t take their child in to the doctor when they need to because of finances. Having proper insurance coverage can help keep your family healthy and ensure they get the care they need in case of an accident or unexpected illness. Kids are unpredictable. My children’s pediatrician is on speed dial because you never know when a previously healthy child is going to wake up in the night with a severe illness or when a child will do something crazy like throw a rock at his own forehead (we’ve actually done that one). If you are unemployed or your company does not offer affordable insurance coverage, check into government sponsored programs that can help you get insurance coverage for your kids.

8. Leaving Lights On

Electricity bills can be expensive, but there’s no reason to pay for electricity to be in use if no one is actually using it. Teach family members to turn off lights as they leave a room and avoid leaving the TV on as background noise. Appliances actually continue to draw electricity when they are turned off but still plugged in so if you really want to cut your electricity budget, unplug appliances when they are not in use.

9. Paying Bank Fees

Bank fees are ridiculously expensive and can grow at an alarming rate. Stay on top of your bank balances and keep a list of bills that are automatically withdrawn from your account to avoid going overdrawn. Overdraft protection protects you from being charged a fee from the company who is pulling money (or trying to) from your account but it certainly doesn’t protect you from being charged fees by your bank. Be aware of what fees your bank charges and don’t be afraid to dispute any you disagree with. If keeping track of your accounts feels overwhelming, try Mint.com, a free service that helps you keep track of all your accounts in one place and sends you email alerts when you are over budget.

10. Carrying a Credit Card Balance

Credit cards are designed to take your money. Everything about them, from the interest charges, to the minimum payment is created in the credit card company’s best interest – not yours. Paying off credit cards can be a long process and can feel like a huge weight on your shoulders. If you can’t pay off your credit cards in full every month, start by cutting up the cards you have, keeping only one in an inaccessible place for emergencies.

Pay more than the minimum every month if possible. Even a few dollars above the minimum payment will shorten the time it will take to pay off your credit card. Call the credit card company to negotiate a lower interest rate and if they won’t budge, look for another card to transfer your balance to. Avoid late charges like the plague. They can quickly double your balance if you aren’t careful. If you do get a late charge, call the credit card company and ask them to remove it. If you have a good payment history they will often remove the charge. If you are really struggling paying off your credit cards, look into non-profit credit counseling services that will help negotiate new terms with your credit cards for you or, with a little bit of work, you can do the same thing on your own.

Living comfortably within your income does not mean you need to earn more money – it may just mean you need to be more respectful of the money that you do have. Being aware of behaviors that waste your money can provide more money to pay bills, put aside for savings, and provide extra money for an occasional splurge.

How do you waste money without meaning to?

More ways to lose money without trying:

* Late charges on bills!! ugh.

* Not having a store frequent shopper kind of card because you fear they are “watching” you – use a fake name if you don’t want them tracking you.

* Being disorganized >> so you can’t find stuff you need and you have to buy it again