7 Things you Don’t Know About Saving for College

Thanks to ScholarShare for sponsoring this post.

Are you worried about how you are going to pay for your kids’ college education?

I know I worry way more about paying for college as a parent than I ever did as a student. Now we have college tuition and other fees looming for 6 kids and, I’ll admit, it’s a bit overwhelming.

The older my kids get, the more I realize how much I don’t know about saving for college. I’m willing to bet most of you are in the same boat.

We sat down with Yvette Haring, (team manager at TIAA-CREF Tuition Financing, Inc. (TFI), plan manager for ScholarShare, California 529 College Savings Plan) to get some answers straight from the expert.

When do you recommend parents start saving for college?

Yvette: According to the College Board, between 2006-07 and 2016-17, published in-state tuition and fees at public four-year institutions increased at an average rate of 3.5% per year beyond inflation. The average total tuition and fee and room and board charges are $20,090 and, at a private institution, are more than $35,000.

As soon as you know you want kids, you can begin to save. A 529 college savings account, such as ScholarShare allows you to change beneficiaries, to another family member at any time, without penalty. Many people establish a 529 account for themselves as a beneficiary and then transfer the beneficiary into their child’s name, once the child is born. Since 529 earnings grow tax deferred, the earlier you can start saving, the better prepared your child will be for college.

What tips do you have for parents who started saving late?

It’s never too late to start saving. Every dollar you save is a dollar less you have to borrow.

According to author Mark Kantrowitz, who is the publisher of FastWeb and FinAid, less than 20,000 students a year receive a completely free ride to college and, among full-time college students enrolled at four-year colleges, just .3% received enough grants and scholarships to cover the full cost of college.

I recommend creating a monthly savings plan and, if possible, plan to save $50 to $100 per month. You might be surprised at how the funds add up over time. Also, with a 529 college savings plan, parents can save as much as they can and as often as they can.

What advice do you have for parents saving for college educations for multiple kids?

529 college savings plans allow you to have one beneficiary per account. In order to save for multiple children, there would need to be multiple accounts. Many 529 plans are a low entry fee. For example, with ScholarShare, you only need $25 to open an account. You can contribute as often as you wish, allowing you to create your own financial plan and, if your employer allows payroll direct deposit contributions, you can contribute as little as $15 a month per beneficiary.

529 plans offer unique gift and estate tax benefits, allowing friends and family to give the gift of college up to $14,000 or $28,000 per married couple.

What role do you recommend kids have in saving for their college education?

Saving for college is a family affair! According to the U.S. Department of Education, the best time to introduce children to college planning is when they are in the sixth, seventh or eighth grade.

Starting conversations about college, saving for college, good study habits and getting involved in extracurricular activities is a wonderful way to let your children know that the family supports them and their higher education dreams. This is also a great opportunity to encourage your children to invest in their education by saving some of the money that they receive as a birthday gift, and teaching them basic lessons about compounding investing.

What is the most important tool parents have in their arsenal when it comes to saving for college?

Time is the best arsenal parents can have.

Time Value of Money (TVM) is based on the concept that a dollar today is worth more than a dollar in the future because you can immediately invest it and generate interest. So, start early, start today. Commit to putting aside monthly contributions, and take advantage of 529 plans tax deferred growth and earning potential.

Are there any resources you find parents overlook when saving for college?

There’s a huge myth: saving for college will disqualify my child from receiving financial aid.

Parent-owned 529 plan assets have a relatively small effect on financial aid eligibility. 529 plan assets are considered assets of the account owner on the Free Application for Federal Student Aid (FAFSA). If the account owner is a parent/guardian, 529 plan assets are factored into the EFC (Expected Family Contribution) at a rate of 5.6% – just like any other parental asset.

What is the biggest advantage to a 529 plan?

529 plans have a lot of features and benefits for parents or anyone looking to earmark for higher education to consider. These features include:

- Tax Free -Tax deferred growth on earnings and tax free distributions on the earning when used for higher education expenses

- Full control – the 529 owner retains full control of the account (not the beneficiary)

- Value – 529 plans can be used to cover a range of expenses, including, tuition, room and board, mandatory fees, book, supplies and equipment as well as can be used at any accredited institution – in-state, out-of-state and abroad and funds can be used towards any degree and or certificate

- Flexibility – to change beneficiaries, change investment options

- Gifting – anyone can gift into a 529 account

- Accessible – Anyone can establish a 529 account, for themselves or a loved one

- No restrictions – There are no age restriction, time limitation or income restriction on 529 plans

A big thanks to Yvette Haring for answering some questions that I know many parents struggle with. She definitely gave me a few things to think about as I move forward in my college savings goals for my kids.

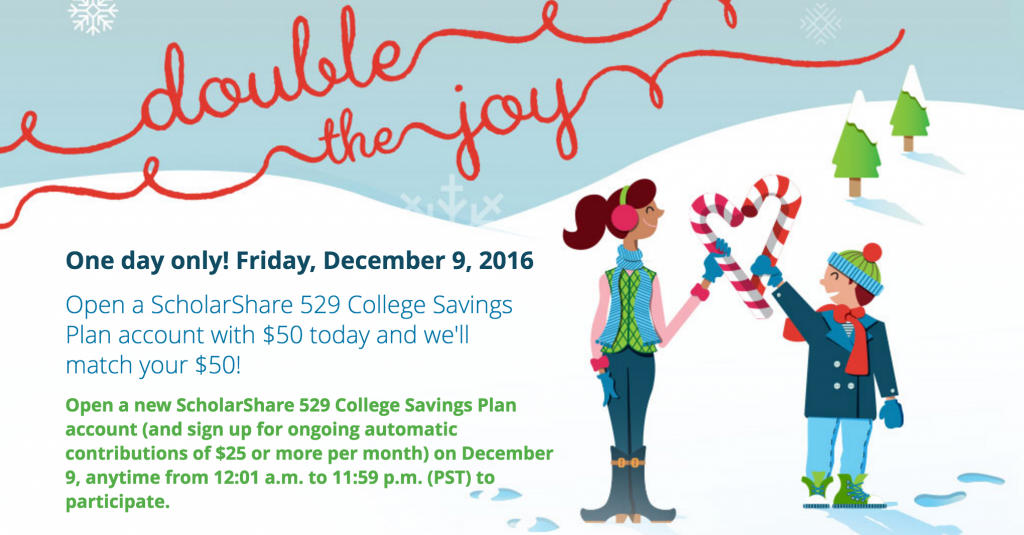

If you want to give your college savings a jump start, ScholarShare is helping to make the holidays twice as bright by offering its second match promotion.

On Friday, Dec. 9, 2016, for one day only from 12:01 a.m. to 11:59 p.m. PST, California families who open a new ScholarShare 529 college savings account with $50 can receive a matching initial deposit of $50 from ScholarShare. Go here for details.

ScholarShare also now offers college savings gift cards. This makes it so easy to contribute to a college savings fun as a holiday gift this year. Physical or digital gift cards are available at California-based Toys “R” Us or Babies “R” Us retail stores or online at www.ScholarShare.com.

To be eligible for the matching promotion, California families will need to open a new ScholarShare College Savings Plan account with at least $50 – to be contributed and invested at the time the new account is opened – and enroll in the automatic contribution plan for the new account with at least a $25 per month contribution. The matching deposit of $50 will be made to the eligible ScholarShare 529 account on or before 11:59 p.m. PST on June 30, 2017. There is a limit of one matching deposit per new ScholarShare account opened for a new beneficiary. Additional details about the matching promotion, including the complete terms and conditions, can be found at www.ScholarShare.com/

Pin it for Later

Great tips. I’ve sent two off to college and it’s unbelievably expensive.