What to Do if You Got a Late Start Saving for College

Thanks to ScholarShare for sponsoring this post.

Did you get a late start saving for your child’s college education and now it feels overwhelming? Saving for college is easier when you start early, but if you got started later, there are still quite a few options.

When it comes to savings, time definitely works to your advantage. Sometimes it just doesn’t work out though, so you have to work with the time you have.

Don’t Wait any Longer

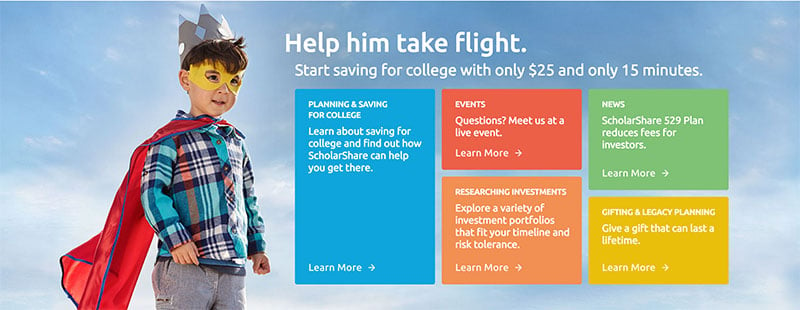

The very first thing you need to do if you got a late start saving for college is stop waiting. Start saving right now, even if you can only save $5. You can open a Scholarshare 529 account for as little as $25. It doesn’t take long to set aside $25 and get your college savings going.

It’s overwhelming. I get that (I have 6 kids that I need to get through college, so I definitely get that). You can’t let being overwhelmed stop you from making progress. Any progress is closer than you started.

Have your Kids Help

When I suggest that parents have their kids help pay for college, I almost always get backlash. I get that as a parent, you want to be able to take the responsibility of paying for college away from your child. Let me give you something else to think about.

My parents paid for my first few years of college (and I was very grateful for that). A few years in, I got married and began paying my own way. The mental shift that happened when I found myself responsible for paying for school was dramatic. I took school more seriously. It meant more to me. I felt prouder when I graduated because I had pushed through and found a way to make it work.

Having your kids help pay for college is not a punishment. You are teaching them to work hard and helping their college experience be more meaningful. Teens can get part time and summer jobs. You could start a family business and have your teen help run it. Get creative. There are all kinds of ways to have your teen help earn money for college. Check out these ideas to help your kids earn their first $25 towards college.

Let family and friends help with your savings goals

You don’t have to save for your child’s college on your own. I’m not suggesting asking for contributions (although if you have a family member who is willing and able to contribute, that’s great). Many friends and family members give money or gifts for holidays and birthdays. Often they do that because they want to show they care but don’t necessarily know what your child really needs or wants.

Suggest that for future gift-giving, friends and family members contribute to your child’s college savings fund. Anyone can contribute to your ScholarShare 529 plan so it’s really simple to make sure gifts go directly to your child’s education. ScholarShare funds can then be used on anything from tuition, to books or even a computer if your child needs one for class.

Look into scholarships and grants

You can give your college funds a boost by applying for scholarships and grants. Look into all the options that you can. Even a small scholarship or grant can help you reach your savings goals. The trick is to apply for as many as you are able to. As you apply, look for trends and see what your teen can do to improve her chance at getting future scholarships/grants. you may find a few areas it would help to focus on.

Invest more conservatively

With college just around the corner, you may be tempted to be more aggressive in your investments. That could be a mistake. A big risk could pay off but it could also cost you a good portion of your savings if it doesn’t go well.

When college is still a ways off, you have time to recover from that. When you need to save for college fast, a setback could seriously derail your college savings goals.

For more tips to help you reach your college savings goals, check out ScholarShare.

Pin it for Later