One Thing you Can do TODAY to Start Saving for College

Are you worried about paying for college?

As a parent, I’m way more worried about paying for college than I ever was as a student.

What if I could tell you there was one thing you could do TODAY that would get your savings goals moving in the right direction? We partnered with ScholarShare to bring you this post and share a great tip to help you start saving for college today.

Saving for college is one of those things that is on all of our to-do lists so why is it so hard to start doing something about it?

I know for me, especially with the thought of paying for college for 6 kids, it’s just so overwhelming. I don’t know where to start.

So I do nothing.

Are you in the same boat?

I want my kids to go to college. Higher education was always encouraged while I was growing up and I always knew that going to college was in my future. My kids know that college is in their future too but with all the immediate needs like braces, kids who keep outgrowing their clothes, and car expenses, saving for college keeps getting pushed to the back burner.

The good news is, saving for college doesn’t have to be overwhelming. I am thrilled to be partnering with ScholarShare this year to help you (and me) simplify the process of saving for a college education.

I sat down with the awesome people at ScholarShare last month to get some college savings tips.

They had some great advice to help you start making progress towards your college saving goals but they had one piece of advice that every parent needs to hear.

Their advice?

Start small.

I know most of you like to tackle goals with everything you’ve got and that’s awesome. I’m right there with you.

The problem is, it can also prevent us from starting things that we can’t do exactly the way we want to. We can’t save for 4 years worth of college expenses right now so we save nothing.

Here’s the thing though: money grows over time when you invest it. The more time you give that money to grow, the easier it will be to reach your college savings goals.

So start early, and give yourself permission to start small.

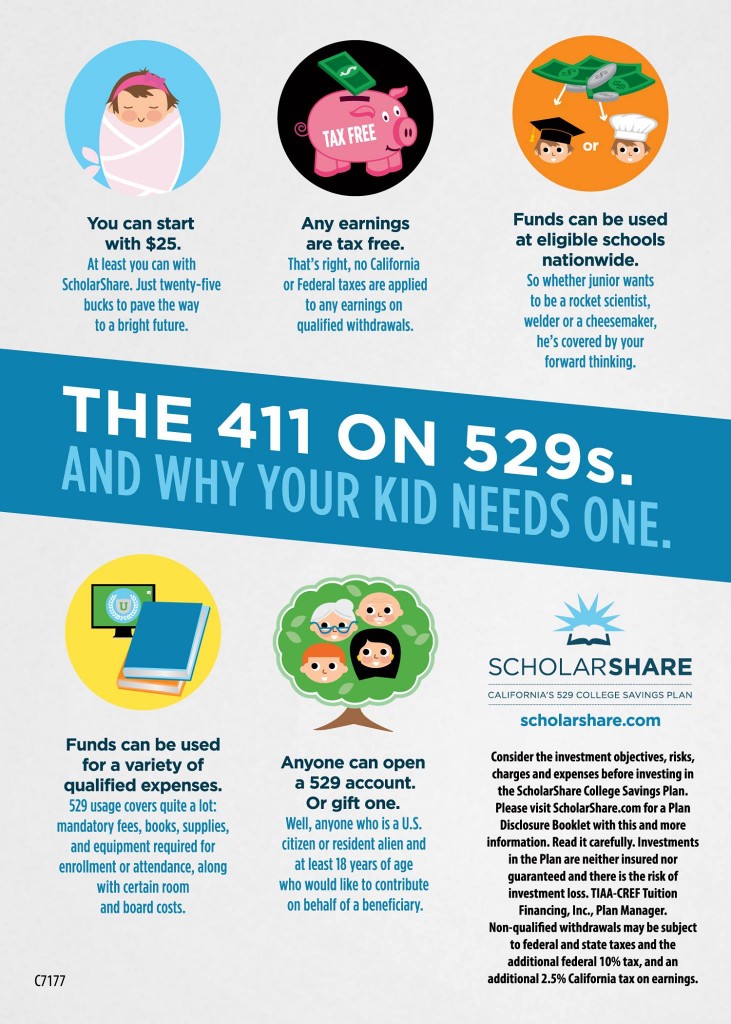

ScholarShare lets you open a 529 account with as little as $25. Opening an account for $25 will help get you on the path towards saving for college.

That’s something all of us can do today.

What is a 529 Savings Plan?

Maybe you are like I was and you are a little unclear about what a 529 account is.

A 529 plan lets you save for college tax-free. It’s like a 401(k) for college.

Because of that, it’s a great way to stretch your money for college. You can even give grandparents and family friends a way to contribute to your child’s 529 plan for birthdays and holidays.

Funds from a 529 plan can be used for any qualified expenses. I knew they could be used for tuition but I had no idea they could be used for books, supplies (like a new laptop) and even some study abroad expenses.

My oldest is almost 13 so college is definitely going to sneak up on me. We’ve been saving for him in a regular savings account and we get almost no return on that money.

This month I opened a ScholarShare 529 account for him so we can get more bang for our buck and I’m really kicking myself for not doing it sooner. The 529 plan will allow us to automate our account contributions (and adjust them as we go). With tax-deferred savings and compound interest, his college savings can grow quickly.

Here’s what I don’t want you to do

Don’t get so overwhelmed that you do nothing.

College is a huge expense and saving that amount may just seem unreachable.

Start small and start today.

Don’t get discouraged by slow progress. It’s better than no progress and you may be surprised at how quickly that small savings can grow once you start making small contributions and having friends and family chip in when they can.

I’m taking small steps right alongside you. I have my oldest son set up with a 529 plan and am going to be creating new accounts for each of my other kids too.

Learn more about setting up a ScholarShare 529 plan here.

Pin it for Later

Disclosure: This post was sponsored by ScholarShare, but all opinions are my own.