How to Save Money with a No Spend Challenge

Have you noticed how all of those little expenses add up? Consider doing a no spend challenge to save money and get your spending under control.

Budgeting can feel like a losing battle sometimes. Even if you are strict and use a budget sheet like this one, those little expenses have a way of adding up quickly.

I remember going through my budget when I was newly married and being shocked by how expensive all of those small expenses really were.

Spending just $10 a day can end up being as much as $300 a month. That’s a good chunk of change, especially if you are trying to survive on one income as a stay-at-home mom.

Having a no-spend month can not only help you reclaim some of those unnecessary expenses and save quite a bit in a single month, but it can also help you retrain your spending habits.

If you are looking for some great reading material during your No Spend Challenge, I love the book Love Your Life, Not Theirs, written by Dave Ramsey’s daughter. It is such a great way to keep things in perspective.

What is a No Spend Challenge?

First, let’s talk about what a no spend challenge is.

To put it simply, you determine a length of time, ideally a full month, where you agree to avoid spending money.

You can set up some exceptions to the rule. Typically these exceptions include regular household bills and gas for your car.

If you do not have a lot of food storage, you can give yourself a strict weekly budget for fresh food to supplement your pantry store.

I’ve found that most people typically have more food in their pantry, fridge, and freezer then they realize. Having a no spend challenge lets you go through those food stores and eat things that would often go to waste because they are forgotten about. This alone can save you $500 or more in a month just by consuming food that would have otherwise gone to waste.

How to Be Successful with a No Spend Challenge

Truthfully, any money that you don’t spend during a no spend challenge is a “success”. Don’t get discouraged if you slip up. It’s just like weight loss — don’t let one bad day pull you down.

Take Inventory of your Kitchen

First, you will need to know what you have to work with. I like to make a written inventory list of everything in my pantry, fridge, and freezer so I know where I am starting from. This will help you find all of those lost things in your freezer.

If you need to, pull everything out of your pantry and organize it first (check out this fantastic pantry organizational system). Throw away expired food and find out what is hiding in the deep recesses of your pantry.

Make a menu plan.

You have the potential to save quite a bit of money simply by not grocery shopping or eating out. To be successful, you will need a plan. Sit down at the beginning of your No Spend Challenge and create a menu plan.

Plan to eat meals that include perishable foods first. Save meals with mostly pantry items for later in the no spend challenge.

Do One Last Grocery Shop

You can fill in the gaps on your meal plan one of two ways. First, you can do one last grocery shop, buying only what you need to turn the food you have on hand into meals. Your second option is to budget a small amount weekly for fresh food, such as milk and produce.

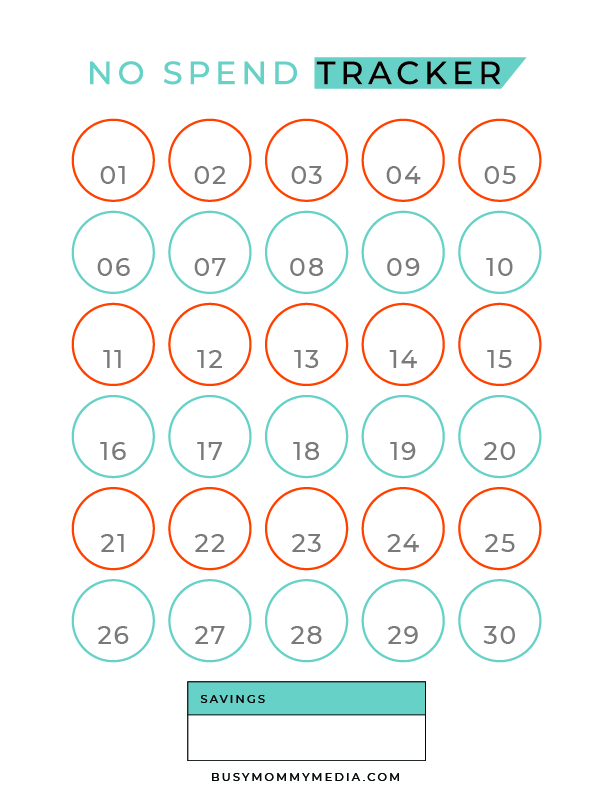

Track the Days

Being able to see the progress you are making can motivate you. Download the No Spend Challenge worksheets below and you can check off each day you are successful with your No Spend Challenge.

Determine Where the Extra Money Will Go

Having a goal insight can help you stick to your No Spend Challenge when things feel difficult. Where is all of the money you are saving going to go? Will you pay down debt? Put it into savings? Put it towards a vacation or larger purchase?

Whatever your goal, put it in writing and post it somewhere visible as a reminder throughout your No Spend Challenge.

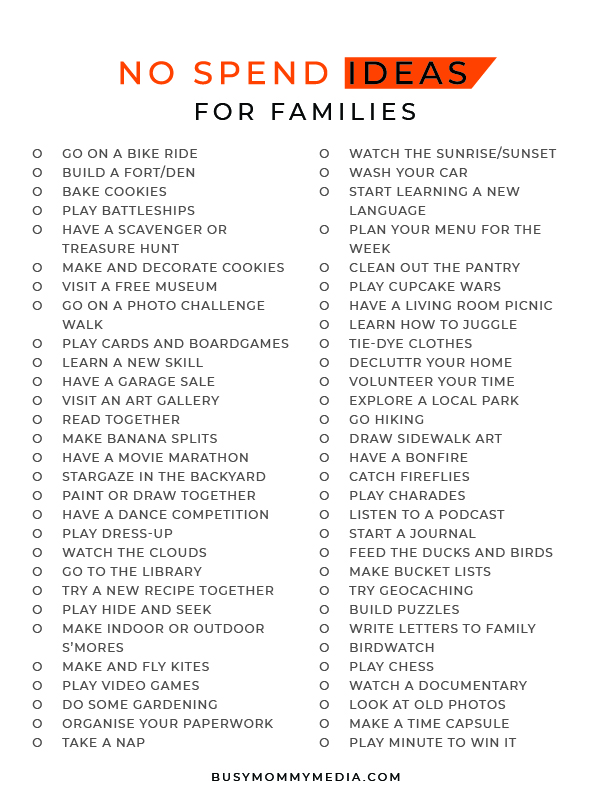

What Can You Do During a No Spend Challenge?

The short answer is, the rules are entirely up to you.

The important thing is to decide ahead of time what you want to allow and what you want to avoid. Below are some suggestions, but again, you can adapt these rules for whatever fits your family’s needs and your current financial goals.

Allowed

- Paying basic household bills (Mortgage/rent, utilities, school fees, etc.)

- Paying credit card payments (definitely don’t get behind on those payments while trying to get out of debt)

- Small grocery runs (Just set a budget ahead of time and determine what you want to allow.

Avoid

- Eating out

- Paid entertainment

- New clothes

- Beauty services or spending

- Travel expenses (unless needed for work)

Fortunately, there are so many free entertainment options that you can take advantage of during a NO Spend Challenge. You may even discover a new passion.

Download your Free Worksheets

Start your no-spend challenge today by downloading these free no-spend worksheets.